Mining Guide

ash2022-09-22T07:43:32+00:00An introduction to crypto-assets

You’ve probably heard of ‘Bitcoin’ – which was the first of many crypto-assets

now in existence throughout the world.

Crypto-assets are digital, global money systems that allow virtual currency to be sent and received via the internet, without being processed by the banking system we use to handle our regular money.

If you think of the global banking system as being a huge ledger of transactions between individuals, companies & nations, crypto-assets have their own equivalent. This is known as the blockchain – a public ledger that keeps track of every transaction taking place in the system network.How does crypto-mining work?

Crypto-mining involves updating the crypto-asset system ledger (or blockchain) of crypto-transactions. The process is carried out by crypto-miners, who use crypto-mining equipment (extremely powerful computers) in competition against other crypto-miners in a race to solve a mathematical problem by guessing a specific number. The first miner who identifies the number correctly is rewarded by being allowed to update the blockchain. At the same time, they receive a reward of newly minted crypto-assets.Within a crypto-asset system, new units of the asset can be generated by the computational solving of mathematical problems. Those who seek to solve the problems are known as crypto-miners and, if they are successful at solving the problems, they are rewarded with units of the crypto-asset each time they are first to solve the latest problem. Rewards can be spent within that crypto-asset system– or can be exchanged for the kind of real money that we use every day.

The types of mining equipment that successful crypto-miners use aren’t regular household computers – these simply aren’t powerful enough. Crypto-miners’ equipment comprises very powerful computer servers, nowadays knowns as ASICs – and the more ASICs a crypto-miner has, the more computing power they have, and the more likely they are to solve the mathematical problem by figuring out the right number before anyone else does.

Crypto-mining in detail

When a crypto-miner’s computer guesses the right number, the computer’s mining program decides which of the many current pending transactions within the crypto-asset system will be grouped together into a block of transactions (thus a number of blocks become the blockchain). The act of compiling this block is equivalent to being handed over the ledger of the crypto-asset system, turning the winning crypto-miner into the temporary central banker and ledger-holder for the entire system. The winning crypto-miner updates the blockchain with the newly created block – and the newly created block, along with the correct solution to the computational problem, is dispatched onto the whole of the crypto-asset network so that all other computers in the network can validate and approve it. The crypto-asset system generates a fixed amount of assets by way of reward to the successful crypto-miner, who also receives any fees that were generated by the transactions that the crypto-miner put into the block that they were compiling. The more mining power you have, the harder it becomes to win. To be inflation- proof, crypto-asset systems need to control the rate and number of new crypto -assets that are generated within the system. This control is achieved by ensuring that when more miners start mining the system, it gets harder toWho are the miners – and how profitable are they?

Miners can be individuals – if they have the equipment and assets to run a solo operation; they might also be big professional corporate outfits that own mining ‘farms’ (vast arrays of computers held in huge buildings, often in places on the planet where power is cheap) – but often, miners are in the form of mining pools: number of miners pool their resources to compete more effectively, then share the resultant crypto-asset wins in proportion to the amount of mining power each contributed. Assessing the profitability of crypto-mining requires balancing a number of factors, and every wise crypto-miner needs to undertake this process when committing themselves to crypto-mining. Factors include: • Cost of energy use: the large amount of computing power needed for crypto-mining uses up vast amounts of electricity, the cost of which varies according to where you are in the world and how much local energy costs.• Mining difficulty: already discussed above, mining difficulty can be expressed as a number representing how hard it is to mine crypto-assets – a factor relating to the amount of miners, and their combined mining power, in the system. This is a particularly tricky variable, since it is difficult to predict how many miners are joining or falling out of the network at any one time.

• Reward per block: The number of crypto assets awarded when a problem is solved can vary – and as time passes, the number of crypto assets being awarded is getting smaller.

• Pool fees: Mining pools take a certain percentage of each pool member’s earnings for providing the pool service.

Crypto-asset mining calculator

Once you have estimated all these variables, you can feed them into the crypto-asset mining calculator and that will tell you how many crypto-assets you can hope to earn monthly.Who are the miners – and how profitable are they?

If you’ve decided that crypto-mining is for you, you’ll need to • Set aside a given amount to start off your crypto-mining enterprise. Only you can decide how much to invest. • Choose your crypto-mining partner – and naturally, we recommend HOSTMINE! That’s because HOSTMINE is tailor-made to your personal wishes, your circumstances and your level of financial commitment.

Latest News

THE BLOCKCHAIN: Delivering major benefits for indian energy

ash2021-11-24T23:17:09+00:00THE BLOCKCHAIN: Delivering major benefits for indian energy HOSTMINE investigates how blockchain can enhance India’s energy industry – proposes blockchain R&D facility benefitting entire nation For most people, the concept of crypto-assets, their generation and trading is about...

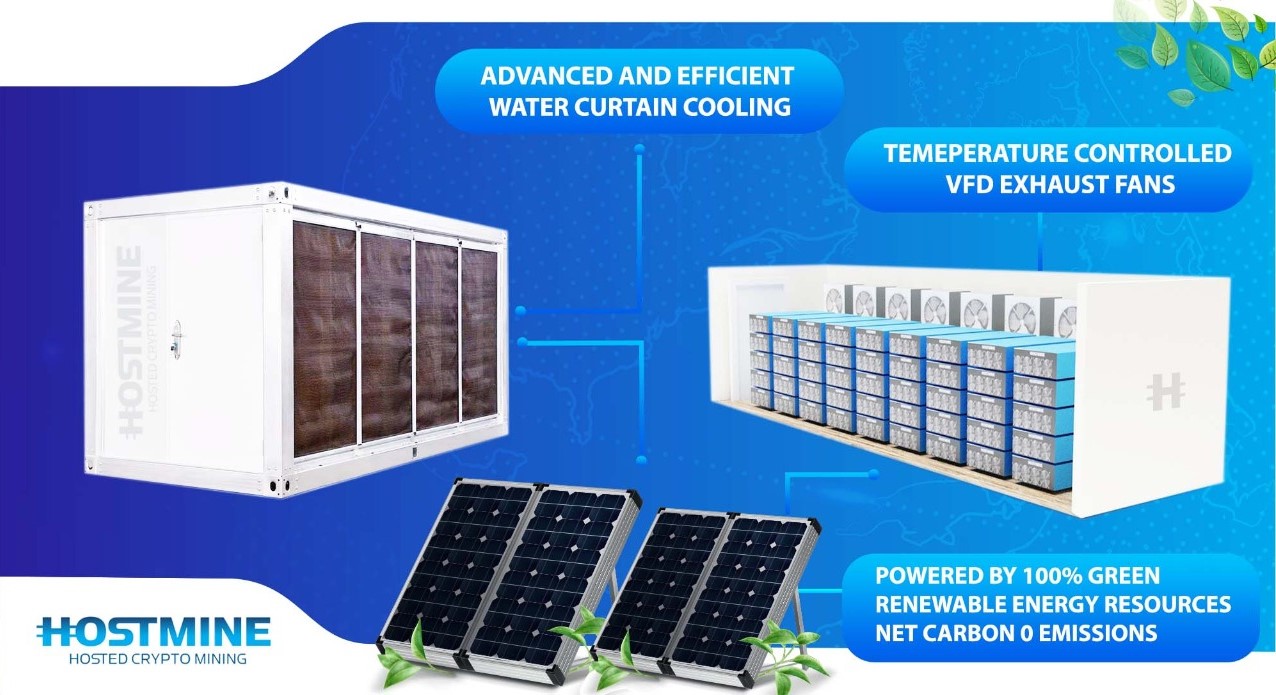

HOSTMINE 20ft Mobile Mining Unit

ash2021-10-18T14:46:40+00:00Twenty foot crypto-mining hosting container Custom designed by HOSTMINE this 20-foot container was configured in China to the highest quality standards. Boasting the latest cooling technology utilising a water wall and 10 massive extraction fans the unit...

0xMiner GPU based multi-crypto mining servers

ash2022-04-29T13:41:24+00:000xMiner GPU based crypto mining servers Mine the widest choice of crypto-assets Minimise maintenance costs Maximise profitable mining 0xMiners delivering maximum all-round benefits 0xMiner GPU based multi-crypto mining servers : HOSTMINE offers custom-designed GPU based 0xMiner servers that deliver optimum operability...